Potential in Uk

and Tax Partners

Who We Are

Premier UK Business prides itself on being a leading provider of professional services in the UK, backed by over two decades of experience. Our team of experts comes from diverse backgrounds and industries, providing clients with unparalleled knowledge and expertise. We understand that every business is unique, so we offer bespoke solutions to meet your specific needs.

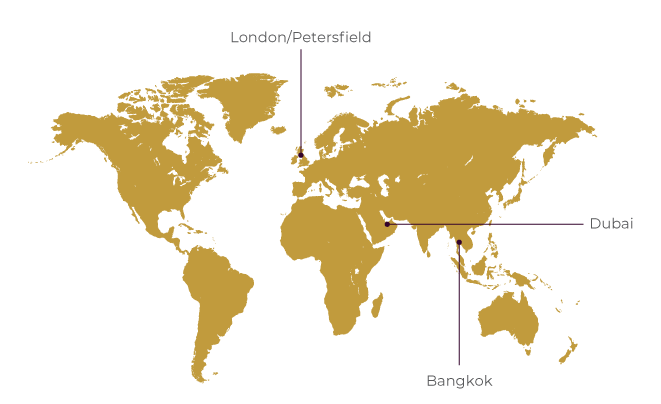

With offices in London, Petersfield, Dubai and Bangkok, we are devoted to providing exceptional service to clients across the UK and internationally. Whether you’re a startup looking to get off the ground, an established business seeking to expand your operations, or an individual looking for expert advice on taxes or immigration, Premier UK Business has the expertise and resources to help you achieve your goals.

Our Philosophy

At Premier UK Business, we are committed to building solid and long-lasting relationships with our clients based on trust, integrity, and transparency. Our philosophy is centred around putting our clients first and providing exceptional service that exceeds their expectations. We believe in fostering a culture of collaboration, innovation, and continuous improvement, where our team members can thrive and deliver the best possible outcomes for our clients

What We Offer

For Almost 23 years, we have been helping UK businesses with step-by-step specialist advice and tailored services. Whether you are yet to set up your company, or are running a well-established business, we pride ourselves on our quality of service across our range of offerings.

Partnership

One of our experienced account managers will get to know your business and your goals, so the advice you receive is tailored to you and your business. Whether it’s getting set up in the UK or tax advice, with our support your business can grow and thrive. Don’t just take our word for it; read our clients’ reviews of our service.

Personal Touch

Whichever service you choose, you can be sure our experts will tailor it to you and your business. Our account managers will be available for any questions you may have; and if there’s a change in your plans, we will adapt our service to ensure your business continues to succeed. Check out our business service.

Expertise

With over 20 years of experience in setting up businesses in the UK and a team of Chartered and certified accountants, you can be sure your business is in good hands. We work with a range of partners, with expertise in VAT, Tax advice, business development and more. Find out more about our team here.

What We Do

What We Offer

For Almost 23 years, we have been helping UK businesses with step-by-step specialist advice and tailored services. Whether you are yet to set up your company, or are running a well-established business, we pride ourselves on our quality of service across our range of offerings.

Partnership

One of our experienced account managers will get to know your business and your goals, so the advice you receive is tailored to you and your business. Whether it’s getting set up in the UK or tax advice, with our support your business can grow and thrive. Don’t just take our word for it; read our clients’ reviews of our service.

Personal Touch

Whichever service you choose, you can be sure our experts will tailor it to you and your business. Our account managers will be available for any questions you may have; and if there’s a change in your plans, we will adapt our service to ensure your business continues to succeed. Check out our business service.

Expertise

With over 20 years of experience in setting up businesses in the UK and a team of Chartered and certified accountants, you can be sure your business is in good hands. We work with a range of partners, with expertise in VAT, Tax advice, business development and more. Find out more about our team here.

Expert service you can trust.

Proven Success

0

0

0

0

Why Choose us

Bespoke Services

We pride ourselves on offering personalized, bespoke services to each and every one of our clients. No matter your financial situation or goals, we will work with you to create a tailored solution that meets your unique needs.

Accredited Professional

Our team is made up of highly qualified and accredited professionals, who have years of experience in the industry. This means that you can trust us to provide accurate, up-to-date advice and support at all times.

International Expertise

With our global reach and extensive international expertise, we are able to provide a truly comprehensive service to clients across the world. Whether you are based in the UK or overseas, we can help you navigate the complexities of international finance.

Cost-Effective Solutions

We understand that managing your finances can be expensive, which is why we are committed to providing cost-effective solutions that help you save money in the long run.

FAQ’s

When the world economy remains uncertain, the UK continues to hold a world- class reputation as a hub for European and US markets. A sound economic policy has delivered stability for small and medium-sized business in the UK, while UK incorporation brings its own prestige internationally. Meanwhile, doing business in the UK makes financial sense. With one of the lowest Corporation Tax rates in Europe, UK start-ups can retain most of their profits. There are also no restrictions on UK companies paying dividends to

shareholders abroad.

Yes – we already have relationships with most of the UK high street banks. Usually, company Directors and shareholders with a share of 20% or higher will be subject to a Know Your Customer (KYC) procedure, verifying your identity and assessing risk. We can help you navigate this process.

You’ll need to register for VAT when you exceed, or expect to exceed, the current VAT threshold. This is based on your VAT Taxable Turnover. Currently, the registration threshold is: £85,000. You can also register voluntarily – we can help you decide if this would be beneficial for your business.

VAT registration can take anywhere from three to seven weeks – or more – depending on how busy HMRC is and any additional information they require. If you have a UK-based Director, the process tends to be faster. While you can continue to trade during this period, our team can help you present the relevant information quickly and efficiently.

Completed Cases

Advisors & Specialists Post-ironic yuccie man braid forage, adaptogen bespoke pour-over. Squid tattooed jean shorts pork belly meh direct trade.

Latest News

Speak to one of our specialists today for Bespoke services

Help us understand your business and learn how are experts can help you with your business.

Book an appointment

Schedule a meeting with one of our experts at a time convenient for you.

Request a call back

We will call you right back during our office hours.

Customers Feedback

A very serious company, respectful of the rules and of people, with my direct contact person Mr. Paololuca Autore always manages to advise me in the best ways to manage my company and business, and also on the tax department the Premier UK Business LLP is very professional and attentive to government and customer laws, so my assessment can only be very positive.

I have used Premier UK Business for the past three years and am absolutely delighted with the service they provide. They are extremely professional, friendly and helpful and have tailored their service to my specific needs, which I particularly appreciate. I cannot recommend them highly enough!

I have been a Premier Uk business customer for 5 years. Very competent staff, especially Mr. Luca Autore. He has always advised me for the best and even recently he proved his professionalism and competence by solving a tax problem very quickly.

Luke always provides me with excellent support for my tax returns. He is always quick to reply and clear with his explanations. Val is also very helpful and I appreciate her reminders.

Your firm is probably one of the very best in the land

-

5th Floor, 22 Eastcheap, London, EC3M 1EU

-

+ 44 20 3880 6572

-

-

Lyndum House, 12 High Street, Petersfield, GU32 3JG

-

+ 44 1730 202532

-

-

Premier Consultancy | Tax and Immigration Consultants - Marasi Drive - Dubai - UAE

-

+ 971 4 580 1700

-

-

622 Emporium Tower, 10th Floor, 21 Sukhumvit Road, Khlong Tan, Khlong Toei, Bangkok 10110

-

+66 2 664 882 120

-